As we enter a more multi-polar world, a new era in global economics is upon us, where old rules are being rewritten and the spotlight is shining brightly upon emerging markets. The world has undergone exciting new advancements in technology, demographic changes, and we are more interconnected than ever before. For the savvy investor, there are many opportunities abroad if they are able to analyze and stomach the risk, as well as properly identify and analyze these exciting new intersections of global commerce.

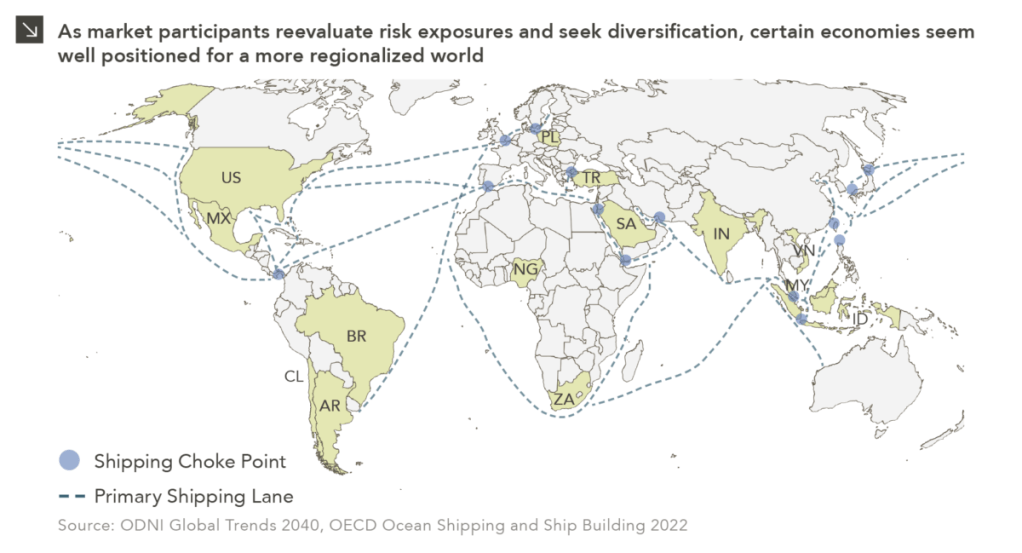

For hundreds of years, the Age of Exploration and colonialism has developed trade routes all around the globe. Some of the most lucrative trade routes and resource rich regions of the 1700’s still remain of utmost importance today. The Strait of Malacca is the busiest shipping lane in the world, the Gulf of Guinea harbors nations who lead the African economy, and most of Latin America is experiencing profound economic growth.

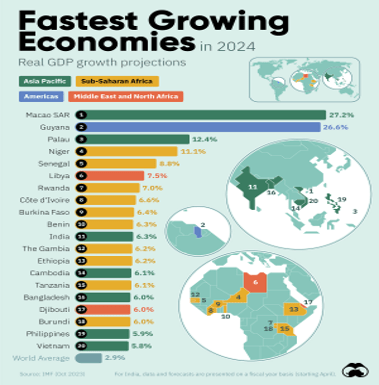

According to the International Monetary Fund (IMF), global forecasted average GDP growth rate sits at around 2.9% for 2024; however, certain countries and trade federations in Asia, Latin America and Africa are forecasted to grow their GDP’s between 5.8% to as high as 26%.

This economic boom can be attributed to foreign capital encouraging entrepreneurship and development, urbanization of developing nations, near-shoring strategies for consumer economies in the post-COVID world, and trade federations coming together to encourage peace and stability.

West Africa:

Various nations in western Africa whose growth vary from 6.2% to 11.1% belong to the political and economic union ECOWAS. Nigeria boasts a rapidly urbanizing population with a developing service and manufacturing economy, while the Guinean and Sahel nations boast extraordinary reserves of diamonds, precious metals, rare earth metals, and oil.

In recent years, foreign investment by foreign firms, typically in Europe or China, have enabled more efficient means of transportation and extraction, resulting in more favorable profit margins, increased extraction volume, and cheaper transportation costs. Of course, these investors also take a stake if not outright ownership of these companies.

Additionally, according to the World Bank, since 1997 these nations had entered the WAEMU agreement, which acts as a custom and currency union between most of the west African nations. Aside from encouraging convergence on a macro-economic scale and a common market, they had designated a French treasury backed currency known as the CFA Franc. This union lowered the mean dispersion of economic growth in the region from 1.26 to 0.73; therefore, improving GDP for all nations included.

Unfortunately, the Sahel states are a hot bed for terrorist activity and rash acting dictatorships. However, along with international involvement, on 16 September 2023, the Sahel Alliance was created to fight against instability to bring order back to the region.

Asia:

Historically, it was the European desire to establish regular trade relations with Asia by navigating a maritime route that was free from Ottoman Imperial tariffs and politics; after all, this is what led to the European East Indies Trading Companies and the European discovery of the “New World”. Today, the Asian market accounts for 2.2 billion of the estimated 4 billion middle-class consumer globally* and offering $10 trillion in consumption growth. Beyond this, as an exporter economy, the APAC region offers attractive labor costs and manufacturing facilities.

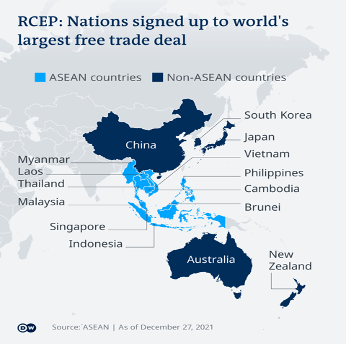

Trade agreements like the RCEP, ASEAN and APTA in 2022, 1992 and 1975 are the largest free trade agreements in history. Many companies and venture capitalists alike seek strategies to leverage these agreements. China has always been the titan in the region; however, doing business with the CCP comes with strings attached. China’s Cyber Security Act passed in 2017 has been contentious to Western politicians and businesses alike. This has been a root cause of China’s reputation for bootlegging IP, as well as engaging in unfair business practices to get an economic edge over competing nations. However, nations like Indonesia, Vietnam and the Philippines are becoming more attractive and developed for importers, manufacturing and outsourced labor needs, without the strings attached. Also to note, Singapore, has one of the most business friendly governments in the world, and has access to Chinese, global and Asian markets without having to sacrifice your investment’s security. Finally, Singapore also boasts a highly advanced and credible financial industry and prosperous service economy.

Latin America:

There exists many opportunities for venture capitalist endeavors in Latin America. For example, Colombia is on pace to grow their GDP 7.3% in 2024 and enjoys a rapidly developing economy. Rich in natural resources and enjoying stability after years of guerilla civil war, their oil, mining, agriculture and manufacturing economy is thriving and in need of foreign capital. Also, Chile, has been experiencing an economic boom due to a robust mining industry. Rich in Copper and Lithium (the largest untapped reserves in the world), EV supply chain and general ore and mineral ventures exist here. However, recently the largest lithium mining company in the country, SQM, experienced a black swan event when the president put forth a law to nationalize the company.

Finally, Guyana boasts nearly a 27% GDP growth and international firms employ Mexican near-shoring to reach US markets easier, especially upon witnessing vulnerabilities in the supply chain during the pandemic*.

Conclusion:

Today, the world is more interconnected than ever thought possible. Brought together via the internet as well as advanced technology, international business and opportunity is more lucrative than ever. Latin America enjoys a high level of stability, as well as proximity to the largest economy in the world, the United States. Asia has the highest number of consumers in the world, as well as an extremely cost effective labor pool and manufacturing hubs. Finally, Africa has some of the greatest potential in the world, by being in possession of some of the most densely concentrated natural resources on Earth and much room for development.

On the other hand, doing business abroad can leave a venture capitalist’s investments at risk if they do not properly consider the political climate of where they are doing business.

To learn more about where these opportunities may exist, please check out GoingVC’s platform, VCStack. There you will find tools to perform deep analysis, remain up to date on the latest developments, and ultimately how to source the deals via tools like Harmonic.

*https://www.brookings.edu/articles/which-will-be-the-top-30-consumer-markets-of-this-decade-5-asian-markets-below-the-radar/#:~:text=Since%202016%2C%20half%20of%20the,2.2%20billion%20live%20in%20Asia.

Homi Kharas and Wolfgang Fengler. August 31, 2021.

* Near Shoring – https://www.wsj.com/articles/nearshoring-shift-brings-production-hurdles-closer-to-home-6fc418ee

Paul Berger, April 24, 2023.

Leave a comment